IRS increases retirement plan limits for 2025

By IU Human Resources

February 05, 2025

The IRS has raised the contribution limits for retirement accounts in 2025, offering more opportunities to save for the future. Whether retirement feels far away or is just around the corner, maximizing your savings today can help you achieve long-term financial security.

What’s changing?

If you participate in one of IU’s supplemental retirement plans — the IU TDA or IU 457(b) — here’s what has changed:

- Those under age 50 can now contribute up to $23,500 to each account, an increase from $23,000 in 2024.

- Those 50 and older can contribute up to an additional $7,500 to each account, for a total annual contribution of $31,000 each.

Why should I contribute more?

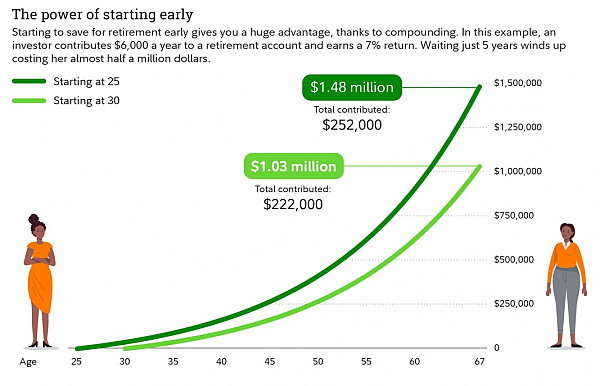

The power of compounding — when your investment earnings are reinvested — can potentially turn every additional dollar you save today into significantly more by the time you retire. By increasing your contributions, even by small amounts, you can set yourself up for a comfortable and fulfilling retirement.

Other key things to keep in mind include:

- Eligibility for the IU TDA includes academic and staff employees appointed at 50% or more full-time equivalent, and employees classified as temporary with retirement. All IU employees are eligible for the IU 457(b) plan.

- You can contribute up to the IRS maximum in both plans each year, potentially doubling your savings.

- Contributions can be made pre-tax, after-tax (Roth) or as a combination of both.

- Participants are responsible for compliance with IRS contribution limits and aggregation rules.

Ready to enroll or increase your contributions? Submit an optional benefit change request through the Employee Center.

How can I learn more?

To learn more about your retirement savings options, how to improve your overall financial well-being, or how to start planning for retirement, IU Human Resources offers virtual education series each spring and fall, Road to Retirement and Road to Financial Wellness.

Navigating retirement savings can be complex, but the IUHR Benefits team and IU’s dedicated workplace financial consultants from Fidelity are available to assist. They can help you understand the new limits, how they apply and how to adjust your contributions.